Did you know nearly half (49%) of households still live paycheck-to-paycheck? If you’re in that category, or just barely getting by, just know there is hope. Applying a little hard work and being willing to learn new skills while applying useful services can help you take control of your finances.

This post is sponsored by Varo.

5 Steps to Get Past Living Paycheck-to-Paycheck

1. Assign Every Dollar – Setting up a budget simply means telling your money where you want it to go, rather than waiting and seeing where it ends up. It’s giving each dollar a specific purpose. By assigning each dollar a place to be you can use your money where it is most important for you and let your dollars help you meet financial goals.

2. Cut Extra Expenses – While you’re budgeting, take a hard look at extra expenditures that really can be cut-that could be eating out or extra clothes or memberships you’re not using. Scale back on services where can get away with a smaller package such as internet speeds or cell phone services. Find places you are overspending and make a plan for how you can spend less throughout the month. Dining out is one of those big expenses that can easily be cut back while still being able to enjoy a few meals out.

3. Save Money Every Month – Make savings a priority and find room in your budget to save money aside every month. Even if that just means $25 or $50 you put aside into a savings account, that can quickly add up to $300-600 by the end of the year. Work up towards saving 10-20% of your monthly income. You can take advantage of retirement savings plans through work or your own cash savings account to help you reach that goal.

Setting money aside and learning to save teaches you how to live within your means and gives you an important buffer to your spending. This one skill will help you overcome the crunch of living paycheck-to-paycheck. Think of this like you online piggy bank!

4. Build an Emergency Fund – There are mini-emergencies that happen all throughout the year like a flat tire, a dental emergency, or a surprise bill. These common occurrences can quickly knock you off track from all your efforts to manage your finances.

It is crucial that you quickly build an emergency savings account. Hold a yard sale or sell some items you no longer use through a swap & shop Facebook group. Put in a little overtime or consider what skills you have that you could pick up a small side job.

Do whatever you can to save up at least $500 in the next 30 days to hedge up an emergency savings. Then, put that savings aside somewhere not too easy to access and only use it for true emergencies.

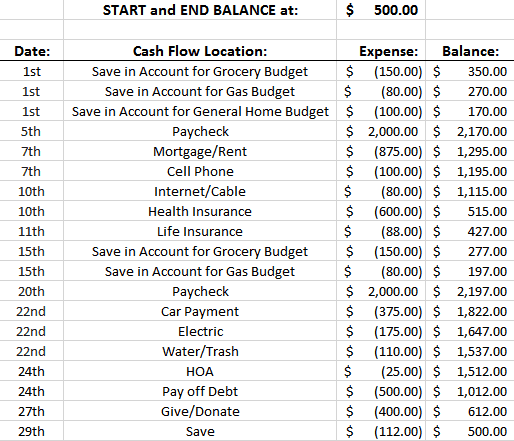

5. Understand “Cash Flow” – A huge hurdle that can prevent you from saving money and keep you stuck in a monthly cycle struggling to make ends meet comes from not understanding when your money is needed and where your money is going each day of the month. The cash flow approach to budgeting will transform the way you see you bank account balance.

Start by writing down your paycheck and income sources by the date they come in. Then, write down every bill you are responsible for along with their due dates. After you have all the set-in-stone expenses and you can see the dates you can start to map out where your money is needed each and every day.

For example, if your paycheck comes in on the 1st day of the month and you have a mortgage payment, electric bill, and cell phone bill all due on the 5th day of the month, you can create a chart that shows what your bank account balance should look like on the 1st and then again on the 5th after those bills have gone out. This gives you a really quick and easy way to understand the dollar amount you see when you login to your bank.

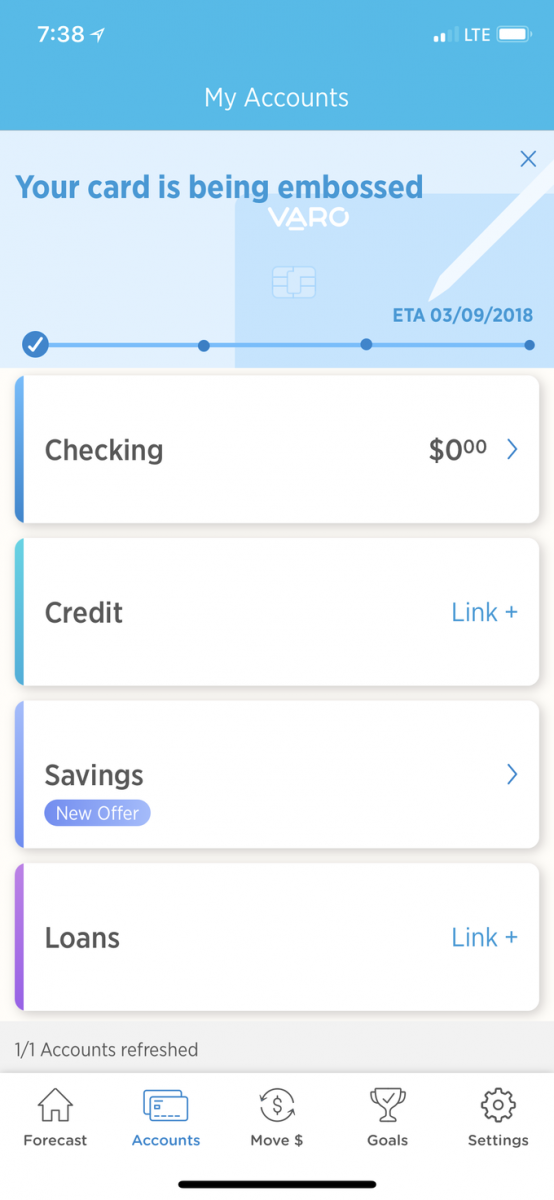

Banking is Better with Varo

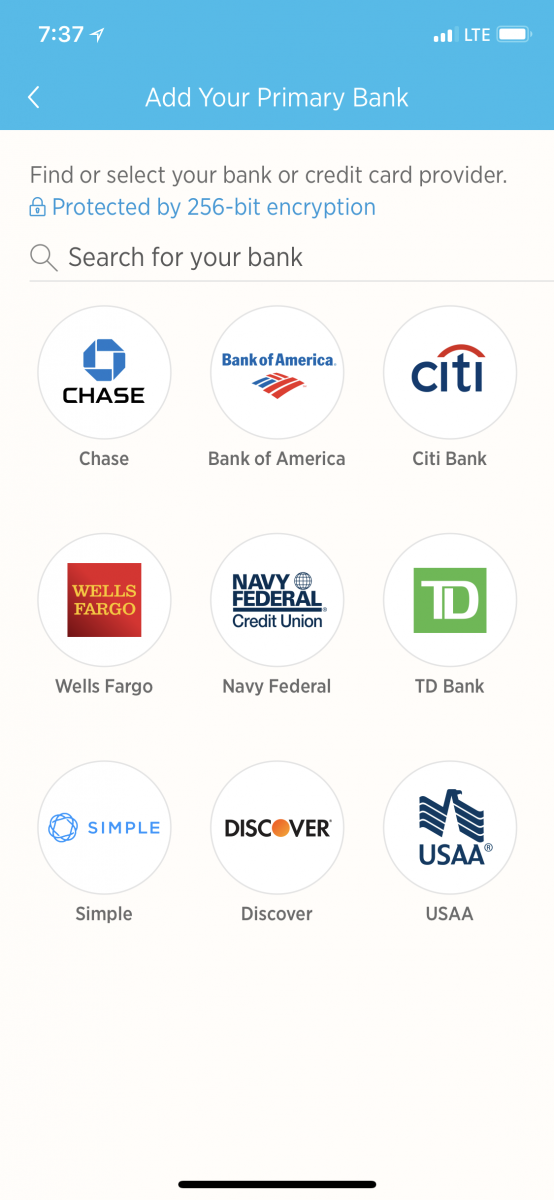

Varo, a banking app for iPhones, has made banking easier and better by simplifying the entire banking experience. They understand the importance of building savings and provide incentives to help you get started building your savings.

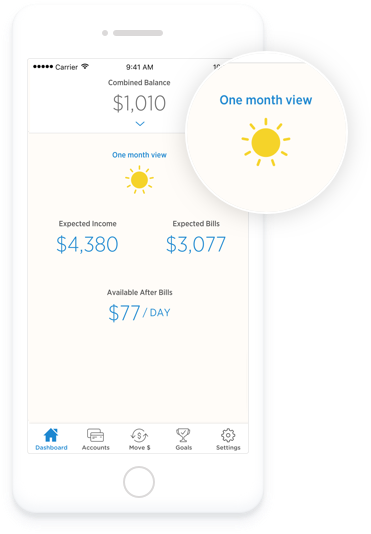

Varo understands how crucial it is to know what your bank account balance really looks like by helping you see ahead throughout the month at the upcoming expenses in a way that makes sense. Varo Forecast gives a simplified look at your monthly cash flow to give you real time information about what money you have — or don’t have — available to spend on unexpected bills or a splurge purchase you might be considering.

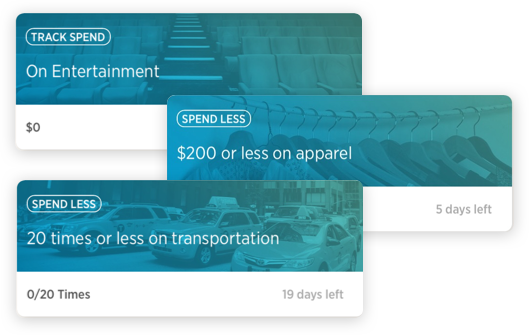

One feature that is really cool is the savings goals and spending trackers that help you visually see your goal — and any spending / savings during the month that apply towards that tracker. This is such a useful way to help you cut back on expenditures like the morning coffee run or lunch out but still give you the flexibility to pick-and-choose what days you cut out while you’re scaling back without having to go completely without your favorite splurges.

More Benefits of Varo Banking:

- Early Payday: Access your paycheck even earlier with direct deposit up to 2 days faster!

- Save Faster: As a Varo savings account holder you can earn up to 1.25% Annual Percentage Yield (vs 0.02% with traditional banks).

- No Hidden Fees: You won’t be surprised with hidden fees and charges. There are no monthly service fees, minimum balance fees, there’s even no fee for the over 55,000 ATMs available worldwide. Allpoint ATMs are located in popular retail stores-like Target, Costco, Walgreens, and CVS-so customers don’t have to go out of their way to get cash at a bank branch ATM.

- Use Your Card Worldwide: Save money when you travel without transaction fees for your purchases abroad.

- Streamline Your Banking Experience: Varo makes it easy to see all your financial accounts. Simply link any checking, savings, loans, or credit cards you want to include and you will be able to view your financial snapshot and recommendations to help you improve your financial health. Plus, you’ll be able to monitor balances with one simple login.

- Bill Pay

- Mobile Check Deposit

- FDIC Insured

With Varo, it’s that much easier to be financially successful. You won’t lose money on hidden fees AND get your paycheck 2 days early with Early Direct Deposit.

Finally, a bank account that cares! Get a Varo account today!

April Duffy

Thursday 19th of April 2018

Solid info, thank you! I recently took a look at expenses and made up a calendar to see where the money was going like you suggest here and it was so helpful! I'm great at saving on things (cloth diapers, coupons, etc.) but seeing everything in the bigger picture was very helpful. My number one place to cut funds: food! Working on that now.

Reesa Lewandowski

Thursday 29th of March 2018

I need to check out this app. Living paycheck to paycheck is a feeling that can really stifle your life!

Allison Cooper

Wednesday 28th of March 2018

These are great tips! #5, understanding cash flow, I think is super important, at least for us. I think until you sit down and really see what's coming and going out it's hard to stick with any budget.

Danielle Fox

Tuesday 27th of March 2018

I love the idea of using the app - my husband takes care of the finances now so I am clueless.

Toni | Boulder Locavore

Tuesday 27th of March 2018

These are really awesome tips! Understanding your financial status is really important. Glad you shared this!