After working through Dave Ramsey’s Baby Steps, I was looking for “what’s next?” and discovered the F.I.R.E. community (Financial Independence, Retire Early). I have learned so much and we as a family are making huge strides towards reaching our financial goals.

But, to really tackle and track our progress, I wanted to create a Financial Independence Checklist to help keep us motivated, on track, and meeting milestones along the way.

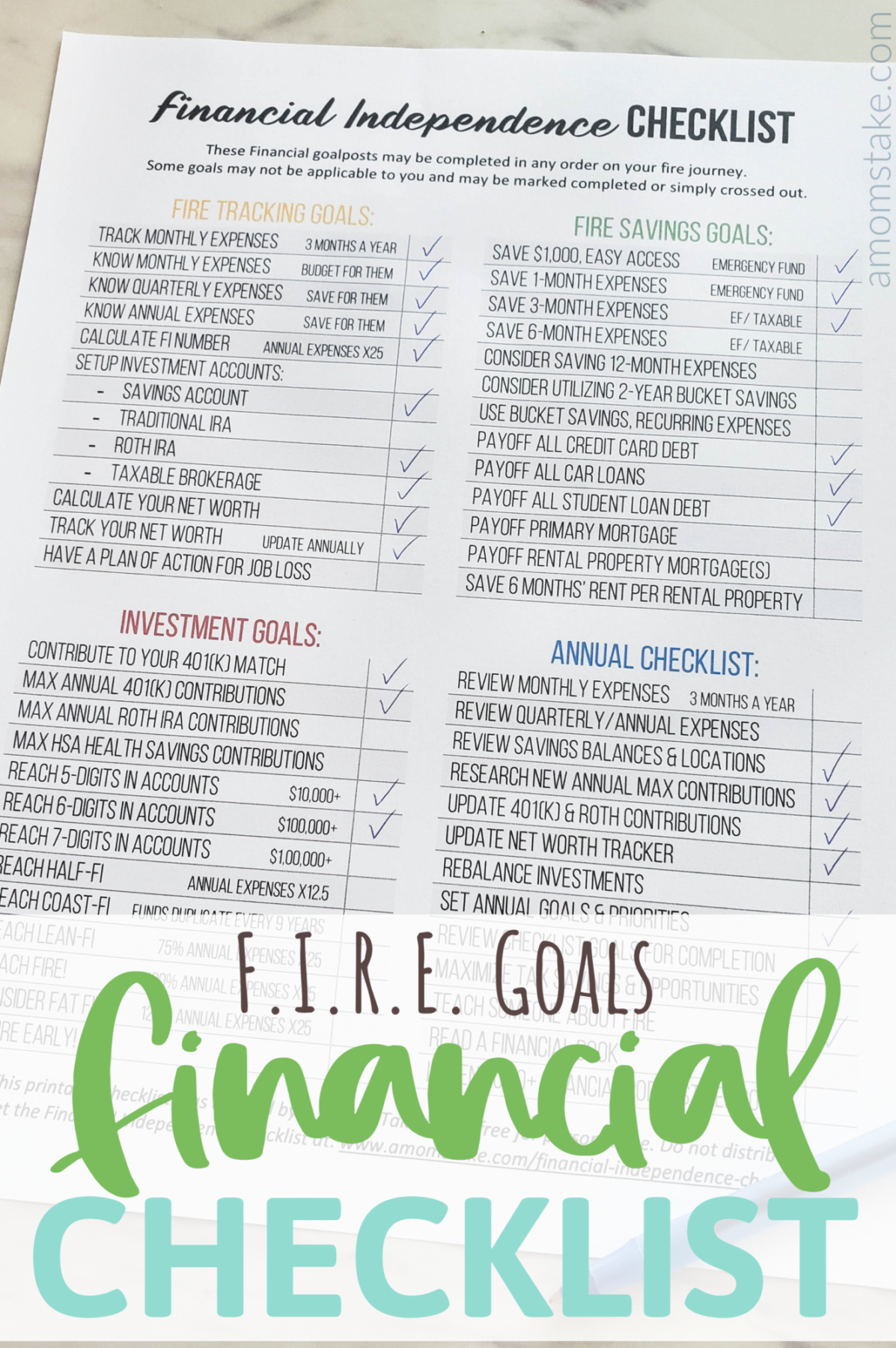

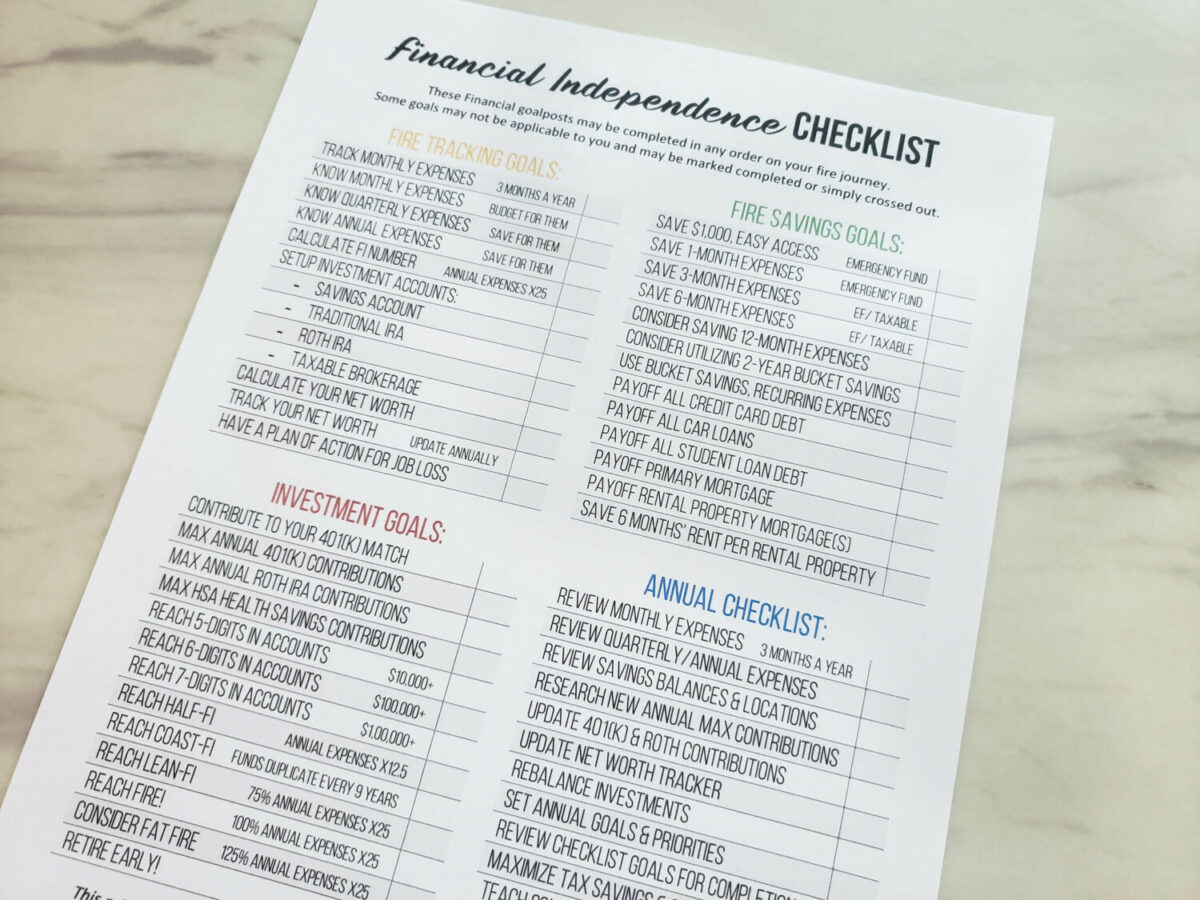

Financial Independence Checklist

Here, you’ll see all the mini goals I’ve included within this Financial Independence checklist that will help you along your way towards reaching F.I.R.E. The goals are broken down in sections to help make it easier to work your way through each of these four main areas towards early retirement!

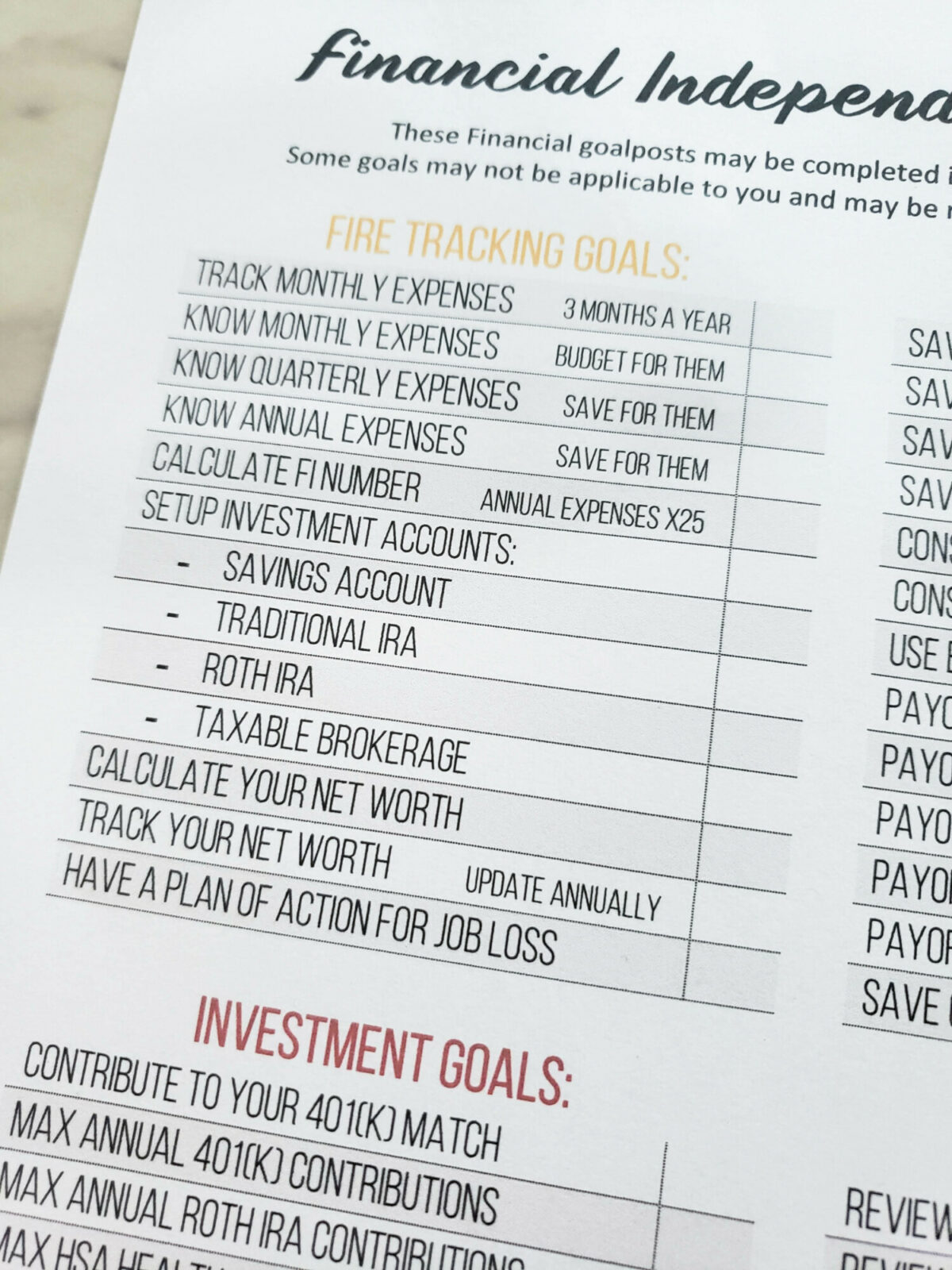

Tracking F.I.R.E. Goals:

- Track Monthly Expenses (at least 3 months of each year)

- Know Your Expenses

- Monthly Budget – Review annually

- Quarterly Expenses – Review annually

- Annual Expenses – Review annually

- Calculate Your FI # (Annual Expenses x 25)

- Setup Investment Accounts so they’re ready to use:

- Savings

- Traditional IRA

- Roth IRA

- Taxable Brokerage

- Calculate Your Net Worth

- Track Your Net Worth – Update at least annually

- Have a plan of action for job loss

- Payoff All Debts – Excluding Mortgage

- Payoff All Debts – Including Mortgage

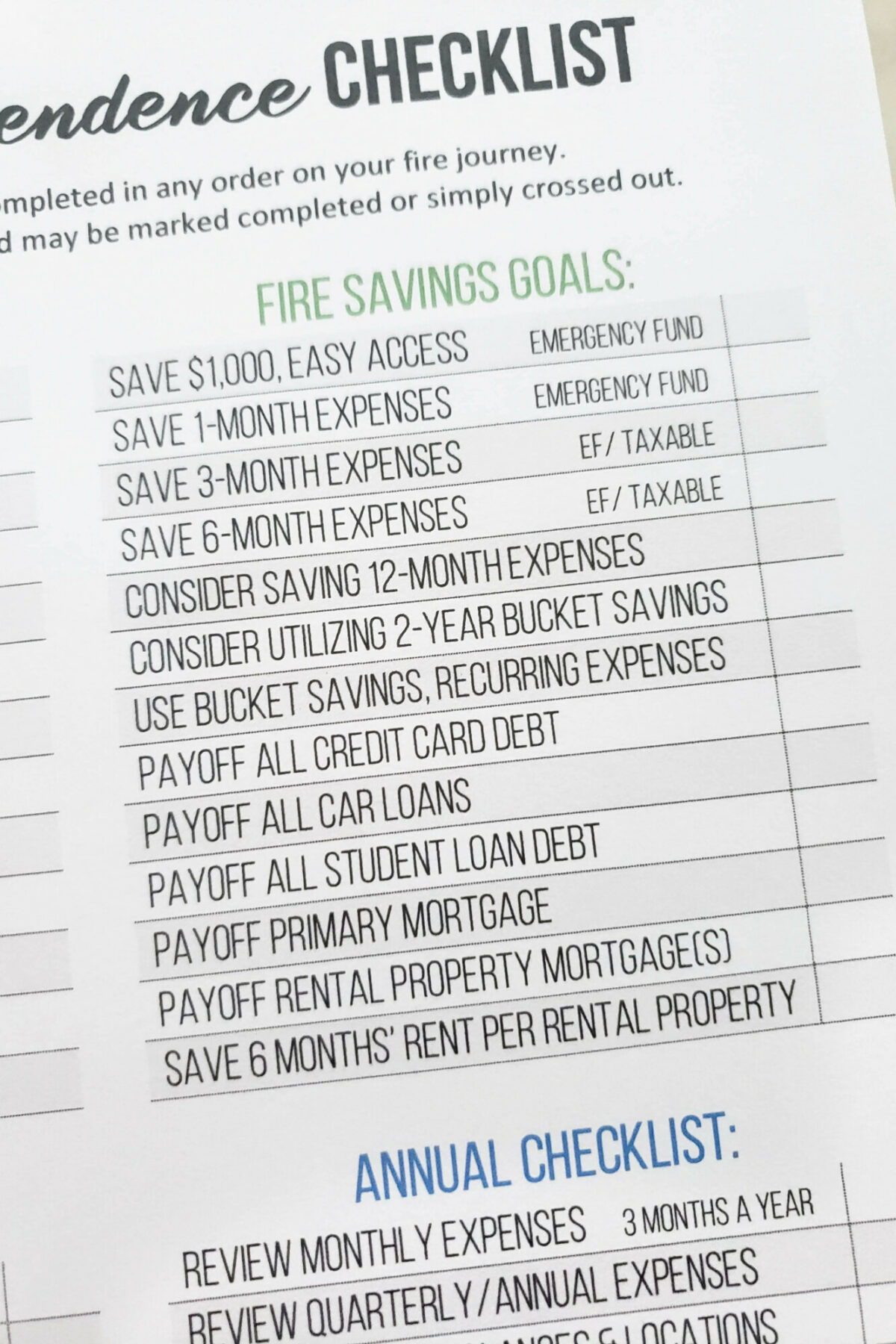

Financial Independence Savings Goals:

- Save $1,000 in an accessible Emergency Fund

- Save 1-month Expenses in an Emergency Fund

- Save 3-months Expenses in an Emergency Fund or Taxable Brokerage

- Save 6-months Expenses in an Emergency Fund or Taxable Brokerage

- Consider Saving 12-months Expenses in an Emergency Fund or Taxable Brokerage

- Consider a 2-year Bucket Savings Approach in Early Retirement

- Utilize Bucket Savings Account to Earmark quarterly/annual recurring expenses

- Payoff all credit card debt

- Payoff all car loans

- Payoff all student loan debt

- Payoff primary mortgage

- Payoff rental property mortgage(s)

- Save 6 months’ rent per rental property

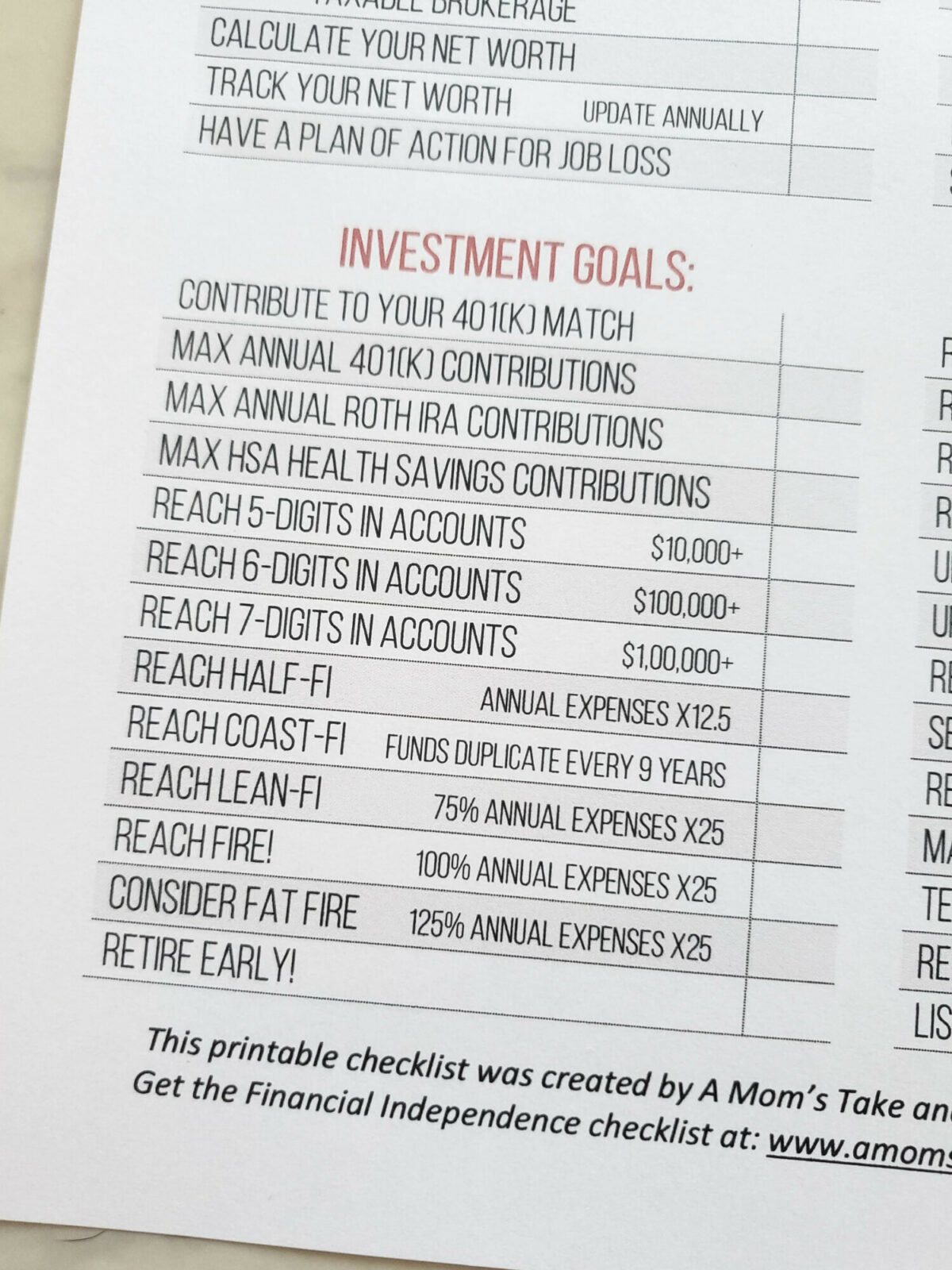

Retirement & Investment Goals:

- Contribute to your 401k Match (or 403b, etc..)

- Max Annual 401k Contributions

- Max Annual Roth IRA Contributions

- Max HSA Health Savings Contributions

- Reach 5 Digits in Accounts ($10,000+)

- Reach 6 Digits in Accounts ($100,000+)

- Reach 7 Digits in Accounts ($1,000,000+) – Congrats, you’re a millionaire!

- Reach Half-Fi (12.5x Annual Expenses)

- Reach Coast-Fi – Can duplicate itself without additional savings (Money roughly doubles every 9 years)

- Reach Lean-Fi (75% of annual expenses x25)

- Reach FIRE! (Annual expenses x25)

- Reach Fat Fire Goal (125% of annual expenses x25)

- Retire Early!!!

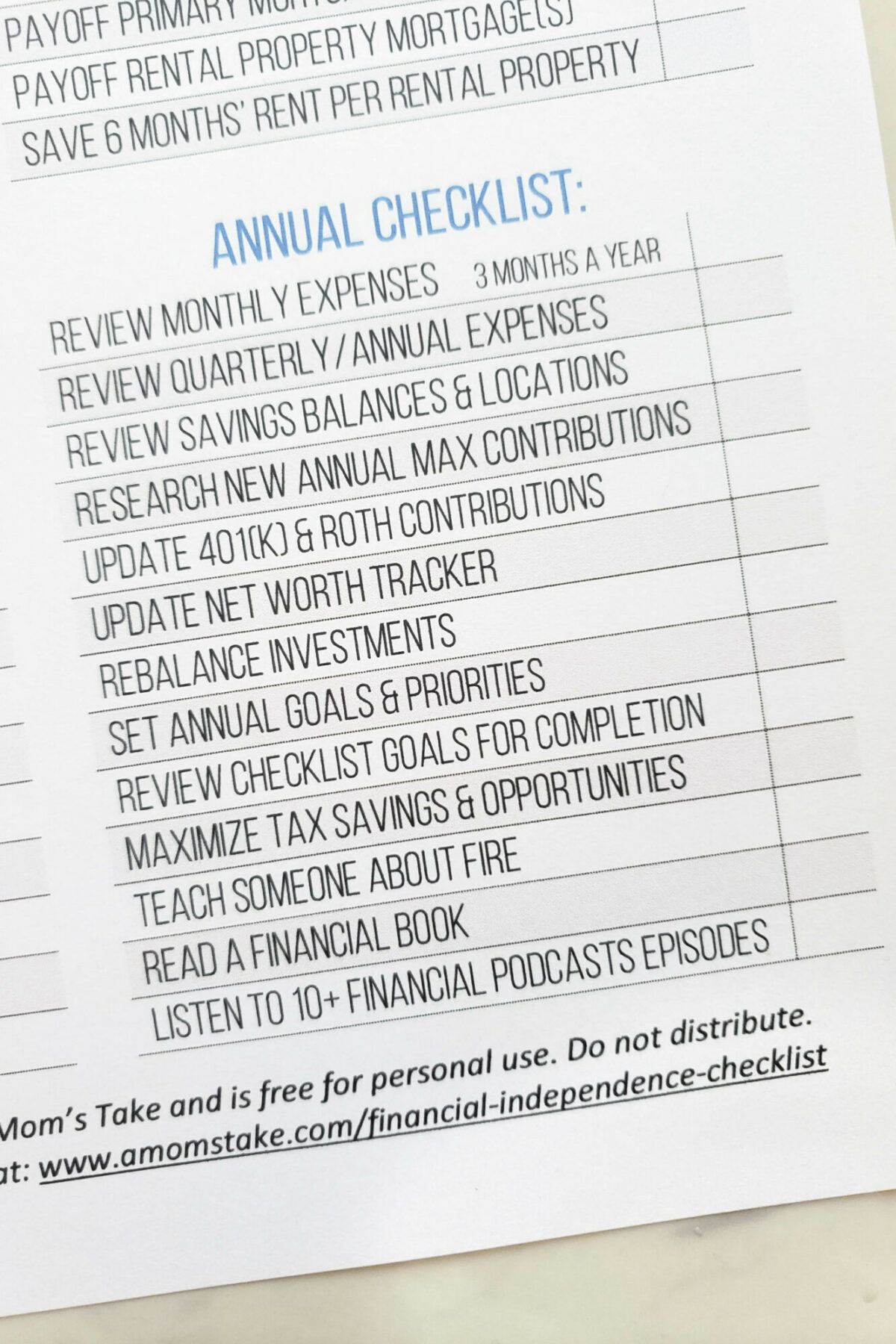

FIRE Annual Checklist Goals:

- Review monthly expenses (track for 3 months each year)

- Review quarterly and annual expenses

- Review savings balances and locations

- Research new annual max contributions

- Update 401(k) and Roth contributions

- Update net worth tracker

- Rebalance investments

- Set annual goals & priorities

- Review checklist goals for completion!

- Maximize tax savings & opportunities

- Teach someone about FIRE

- Read a financial book

- Listen to 10+ financial podcast episodes

We have a fun financial series of worksheets on this blog that can also be really helpful in working towards your financial goals. Like this Family Budget Worksheet that helps you set goals while working through a budget each month.

Printable Financial Independence Checklist

Get started tracking your own Financial Independence goals and progress with this free printable FIRE checklist! It’s just a single page printable that makes it easy to display and take actionable steps towards your goals!

I recommend printing off a new Financial Independence checklist at the start of each year and looking through each of the milestones and goals along the way. This will help you to take inventory of what you’re working towards and refocus on new priorities for the year ahead.

Tracking your progress and your goals can go such a long way towards motivating you to stay the course and reach for those goals, and it is my hope that this FIRE Checklist will help you on your journey to FI!

Did I cover all the aspects to help you along your FIRE journey? What other milestones would you add to this checklist?

Mark

Tuesday 10th of May 2022

Great blog! I'm going to follow your advice, by firstly printing off some sheets

Janel

Monday 23rd of May 2022

Best of luck on your FIRE journey!! <3