When I first got married, I was completely clueless about how to manage and budget my income. It left our family living paycheck to paycheck and always wondering where our money was going.

When we finally started budgeting and taking control of our personal finances like where our money would go each month, our whole financial situation changed. Now, we were telling our money what to do and creating financial goals, too!

I’ve created this free family budget worksheet to help encourage others to take control of their own financial future and track their expenses on a monthly basis.

This is a super simple budgeting method that tracks how much money goes to each of the major categories and helps you find places you can cut back, save, or really evaluate your monthly expenses.

How to use the Family Budget Worksheet

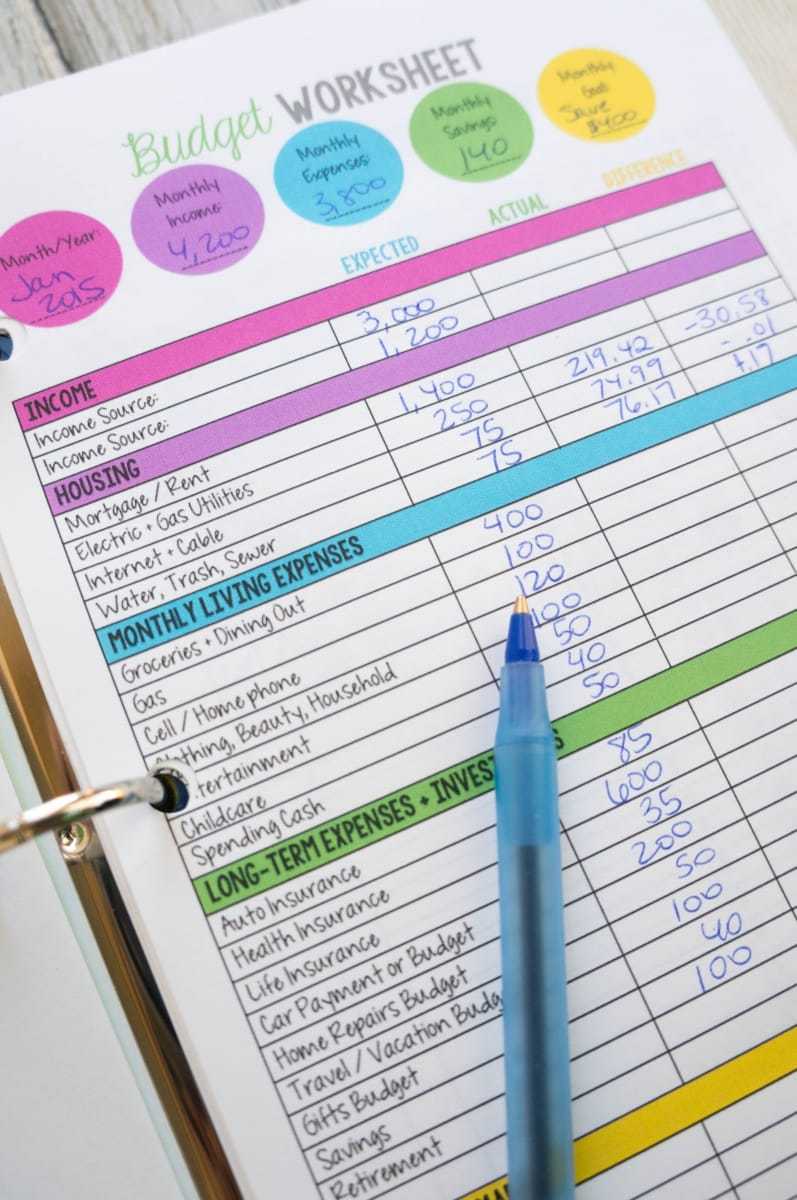

Start each month by planning for your expenses and income. If your income varies from month-to-month, start saving up a one month cash reserve and then start budgeting off of you previous month’s paycheck so you can have an exact amount to budget each month.

Fill in each of your bills and budgeted categories on your family budget worksheet with how much of your income you will allow for each category.

Keep in mind it’s a good idea to budget for longer-term expenses like home repairs or gifts so that you aren’t hit with one big expense when birthdays roll around or your air conditioning breaks.

Set aside what you budget for areas like this each month in a separate savings account or pull them out as cash so they don’t get spent on impulse purchases.

At the end of the month, record what you spent in each area and then sum the difference for each row. Take a look at how you did in each area and evaluate what needs to change for the next month. If your bill was higher than expected, determine why.

Did you over spend at the grocery store? Consider using a cash envelope system to stay in your budget.

Was your electric bill higher than anticipated? See if there are ways to cut back energy use or find other areas you can adjust to accommodate a more accurate typical bill.

Use what you learn each month about your spending habits to improve your own ability to balance your accounts and manage your finances.

Come see our next free budgeting printable – a Monthly Bill Pay checklist! You can subscribe to my once a week newsletter and get an updates on new posts. I have a whole series of worksheets scheduled with a new printable every other Friday.

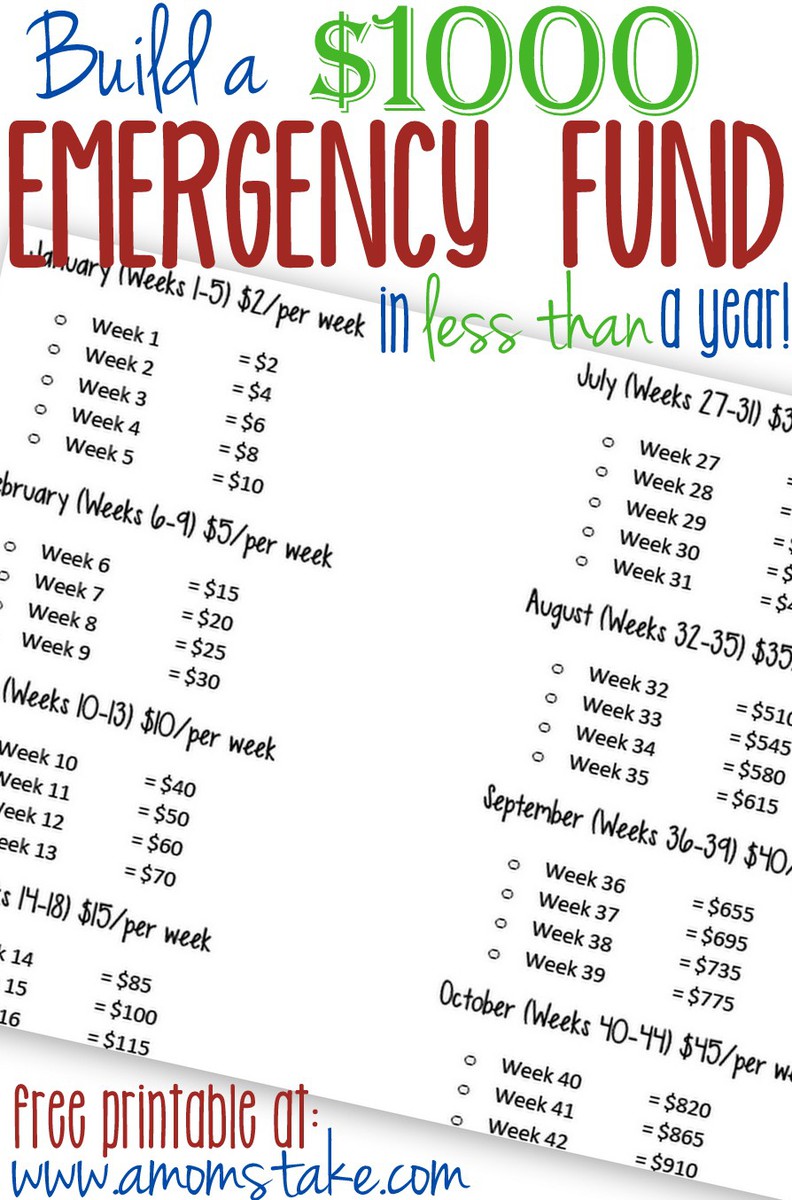

Up your savings goals easily by saving just $2/per week with our Emergency Fun Savings tracker!

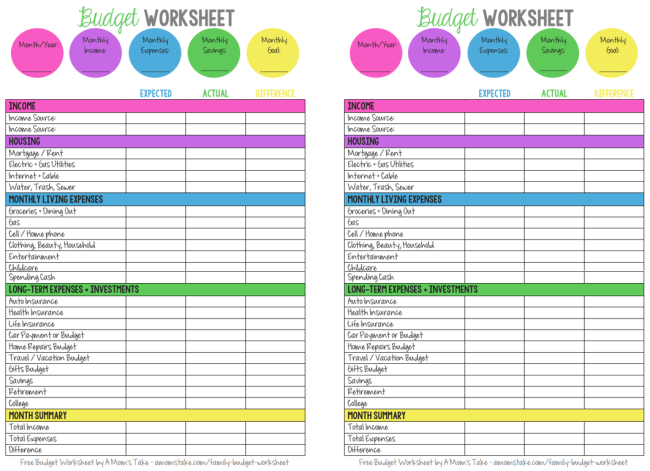

Get the Free Printable Budget Worksheet

To download the free family budget worksheet printable, click on these links or the image above! It will open in a new window where you can view, save or print the PDF. If you save the file to your computer you can print it as needed.

This free printable monthly budget templates help you to track your monthly income, gives you an expense tracker by breaking spending down into budget categories, and helps you take control of your finances! You’ll use your actual income each month to fill in the simple templates.

You’ll be amaze as you look back through your family budget planner after a few months and start to see your progress and actual financial data starts to appear! It really helps you track that discretionary spending and works as a debt tracker to highlighting your progress along the way!

The different colors help differentiate between your spending buckets and it’s easy to see everything at a glance with just a single page per month to print!

This printable file is free for your own personal use.

Click Below to Download the

Family Budget Worksheets!

** Family Budget Worksheet – Letter Size **

Now, a brand new version where you can easily fill in your budget before printing and then continue to edit on paper!

** Fill-In Family Budget Worksheet – Letter Size **

Mini Family Budget Worksheet

** Family Budget Worksheet – Mini Size **

This family budget worksheet can be printed in full letter sized paper or download the mini binder printable version and store it in a small binder which is easier to store and portable!

These are some of my favorite mini binder supplies. I personally use a mini binder for my home management papers as I like how little room it takes up in my kitchen drawers.

Sherry

Friday 6th of February 2015

I'm actually afraid to put anything on paper. Thanks for linking up to Funtastic Friday. Hope to see you again this week.

Monthly Bill Payment Checklist - A Mom's Take

Friday 23rd of January 2015

[…] grab our first free budgeting worksheet a Family Budget Worksheet! I’ve got another free printable worksheet to share with you in two weeks. Check back to grab […]

ShopHounds.com | Family Budget Worksheet

Wednesday 14th of January 2015

[…] Read More at A Mom’s Take […]

Link Round-up: Budgeting Tips, Recipes, Tank Top Organization, and More | Smart Mom Picks

Tuesday 13th of January 2015

[…] A Mom’s Take shared a family budget worksheet. […]

Ellen Christian

Monday 12th of January 2015

It's really important to stay on top of expenses. Having a budget really helps you stay informed about where your money is going.