As a college student myself, I know how overwhelming it can be when you think about how much money you need to get there. I have friends that have had college tuition accounts saved up for them from birth. My parents never made enough to be able to do that.

So here I am, accepted, transferred and getting ready to start my first semester at the local university. Like most of you, I am sitting here looking over numbers and thinking about what I should have done to make this an easier burden, and what I can do now. If you have children to eventually send, or your trying to send yourself, I have come up with a few ways to help you ease the burden of paying for college.

This post is sponsored by College Ave Student Loans. All opinions are my own.

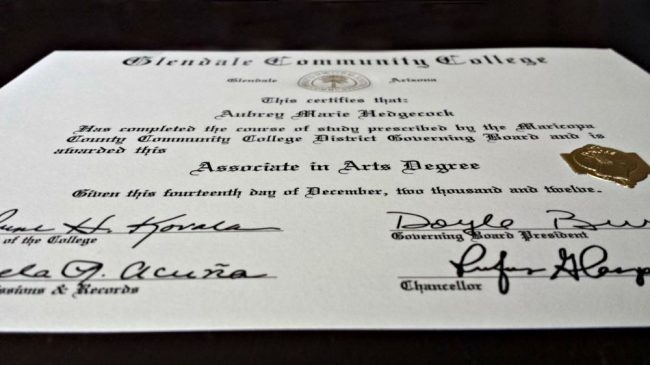

Transfer from a community college- Most people change their major somewhere in the beginning anyway. Going to a community college first can help ease a lot of the financial burden. Community colleges are much less expensive and offer many classes that transfer to most major universities. If you know which university you want to attend, there may be something like a MAPP that you can follow so you only take classes that transfer and don’t waste any time with non-transferring classes. I was on a MAPP to ASU and it locked in my tuition, so when I was ready to transfer, I paid whatever tuition was at when I signed it.

Grants and Scholarships- Even if you don’t think you qualify for financial aid, apply anyway. You may be surprised and it doesn’t hurt. Grants can help with a huge chunk of tuition costs. Also, apply for as many scholarships as possible. You may not get one, but then again, you might. It is such a load off when you earn a scholarship. If you’re having trouble finding scholarships, ask your school. Most schools have a scholarship database they will send you to.

Loans- If you have saved as much as possible and still don’t have enough, you may need to take out loans. There are many different types of loans. Major loan types are subsidized, un-subsidized and private. Subsidized and un-subsidized loans are loans from the government. Subsidized loans have the interest paid for you while you are in school. When federal loans, grants and scholarships aren’t enough, private loans can cover the rest. This is where College Ave Student Loans can help.

College Ave Student Loans is an online marketplace lender, specializing in student loans. They deliver loans that are simple, clear and personalized for each individual’s needs. Their rates are competitive and they have the most repayment options. They never want families to borrow more than they need, or pay more than they should. College Ave has a few neat tools to help in the loan decision making process.

One of their useful tools is the loan calculator. It helps the families understand the total cost of borrowing and ways to save. You can play with the numbers and see what you will owe and when it will be paid off. Another useful tool is their pre-qualification tool. With three simple pieces of information, students and parents can find out if their credit score qualifies for the loan and what rates they can expect. It’s done without even filling out an application or impacting your credit score. Check out their mobile-friendly application and get a credit decision in less than three minutes.

A great way many students, or parents wanting to help, keep their debt down is by paying $25 a month on their loan through school. College Ave rewards good choices, such as this, by giving lower rates. College Ave offers the most choices for when to start and how long to pay back. There are no fees to apply, or to pay the loan off early. You can even get a .25% interest rate reduction when you sign up for automatic payments. Start taking advantage of the low variable rates and everything College Ave has to offer today. Visit College Ave and let them help you ease the burden of affording your education.

Liz Mays

Tuesday 11th of August 2015

These will definitely help you in the long run. My son did community college for a year to get some courses done for cheap between transfers.

Vera Sweeney

Tuesday 11th of August 2015

These are great tips! It really is scary how much college can add up to and it seems to get more expensive every year.

Kathy

Tuesday 11th of August 2015

Great tips! College is very expensive and I always encourage everyone to try to get a scholarship if possible. I'll be checking more in to this when my daughters get old enough to go to college. Thanks for sharing.

Chelley @ A is For Adelaide

Tuesday 11th of August 2015

This is such great resource! I know when my kids go to school, we will be using a combination of ways to pay for it!

valmg @ Mom Knows It All

Tuesday 11th of August 2015

College costs range from expensive to ridiculously expensive. I went back and got my Associates in 2013, I had a grant.