When I was a new mom with two little boys under foot, life insurance was the last thing on my mind. But after taking a course on money management and as we started to pay off our debts, we quickly started to understand the importance of a term life insurance policy for helping to financially protect our family, now and in the future .

This term life insurance guide for new parents will help you understand common questions behind insurance policies.

This post is sponsored by Haven Life Insurance Agency. All opinions are my own.

Life Insurance Guide for Parents

Q: What is life insurance and why would I need it?

Let’s start with the basics. A life insurance policy pays out a guaranteed amount of money to your beneficiaries if you were to die. Most commonly, a beneficiary is your spouse, kids or other family members. If you have a spouse, kids, just bought a house, or have co-signed debt like student loans or credit cards, you should consider life insurance. In the event something would happen to you or your spouse, life insurance can help to cover things like lost income, living expenses, paying a mortgage and other debts, funding college expenses, or even paying the medical bills from an early and unexpected death. Life insurance can act as a safety net to help provide for your family should you no longer be able to.

Q: What is term life insurance?

Term life insurance is a policy that is good for a specific term length, such as terms of 10, 15, 20, and 30 years. You choose your length of coverage needed; for example maybe the years you expect to be raising and caring for children or a term that spans the length of the mortgage on your house. The rates never change or go up – you’ll pay the same monthly fee for the entire length of the term.

Now that we know what term life insurance is, let’s talk about why you may need it.

Why Term Life Insurance?

Term life insurance is something you hopefully will never need, but you can rest easy knowing it’s there. It is a simple step towards helping to protect and care for your loved ones should something ever happen to you.

There are several different kinds of life insurance available for purchase, but for many parents still in the child raising years, term life insurance is a good option.

Term Life insurance features affordable rates, options for coverage limits, and will protect you through the years you’ll really need it. Think about it this way – a term life insurance policy can be there to help your partner or spouse finish raising your children and be a support until the kids are out of the house.

By the time your children have left the nest, you may be in a better financial position after some 20+ years of working to be able to feel more financially secure in your future. Should you or your spouse pass away at this time, the expenses may not involve as significant a loss as they would be while raising children and losing either a primary financial support or a homemaker that provides all the care for the children and household.

How Much Term Life Insurance Should I Choose?

Financial experts recommend a term life insurance policy that is 5 to 10x your current annual salary. That would mean a family that brings home a $50,000 annual salary would aim for as much as a $500,000 term life insurance policy.

If you aren’t sure how much coverage you need, consider what costs you might have if your love one passed. A policy 10x their annual salary could effectively bring you their annual salary each year if invested. Or maybe all you would need is enough to pay off a mortgage to lower your household expenses.

Term Life Insurance is More Affordable Than You Think

You might be surprised by just how inexpensive a term life insurance policy is. A term life insurance policy could cost less than your monthly gym membership, coffee trips, or other everyday expenses we pay for without a second thought.

Would you be able to give up one cup of coffee a week or a dinner out once a month to provide your family with the security that can come with a term life insurance policy? Once we understood all the whys behind life insurance, it was an easy choice for us.

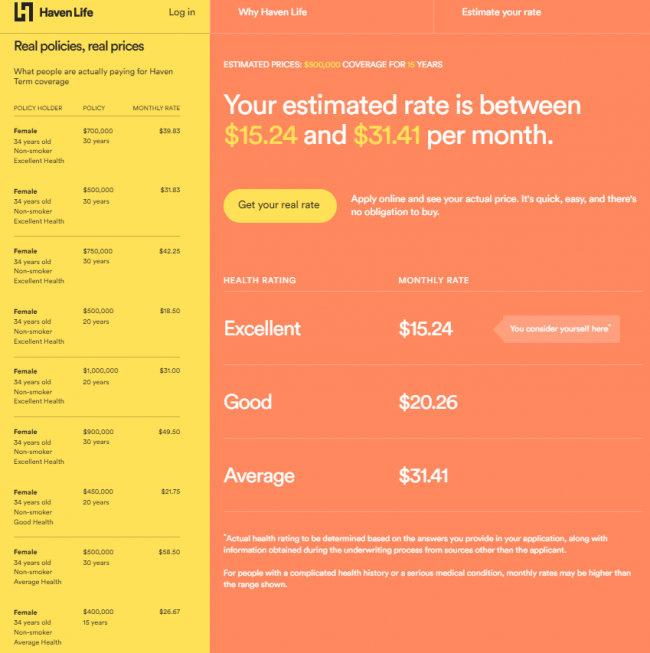

My quote would enable me to purchase a 15-year $500,000 Haven Term policy, issued by MassMutual, starting at about $15.24 per month.

That’s under $200 per year and less than a $3,000 expense over the 15-year policy that would pay out a half a million dollars should it ever come to that with an untimely early death. That gives me so confidence in my family’s future. With a term life insurance policy like that in place, I know I’ve taken steps to protect my family financially, despite the loss they would endure. The payout from a life insurance policy can be used to help pay my family’s ongoing expenses during a very difficult time.

Getting a Life Insurance Quote

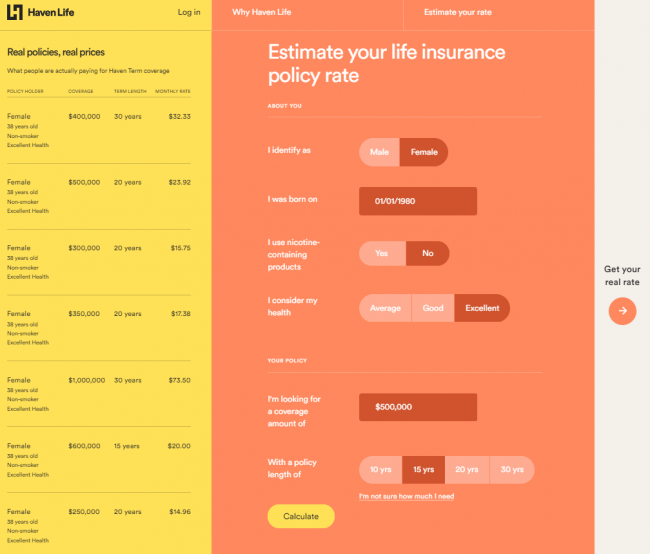

If you’ve always wanted to know what term life insurance rates might look like for you, it is easy to check. Haven Life makes it straightforward and easy to see your rate estimate with just 6-simple questions. They will just need to know:

- Gender

- Birthday

- Nicotine products use

- Health self-assessment (average, good, excellent)

- Term life insurance policy coverage amount

- Term life insurance policy length

They won’t ask for your name, email, address, phone number or other personal information to calculate your estimated rate, which is so helpful. I can’t stand when companies aren’t clear and upfront locking any basic information behind an email or phone number request page.

With Haven Life, you’ll be able to view those rate estimates upfront in a clear and easy to understand chart. You’ll even be able to view real rates that others similar to you are already paying for their term insurance policies. It’s quite addicting, too, to play around with the policy amount and term to find just the right combination to meet my budget and needs.

How Do You Buy Term Life Insurance?

One of my favorite things about Haven Life is how easy they make it to buy a policy. If you choose to apply, you can do so online. It’s simple and can be done from your phone, tablet or computer. And, applicants get an immediate decision on coverage eligibility. You don’t need to wait several weeks for an answer like you do in the traditional process. Haven Life also has expert and friendly customer support available via phone, email, or chat in case you have questions.

Help protect your family and loved ones, by considering a term life insurance policy today. Apply for term life insurance through Haven Life.

Haven Term is a Term Life Insurance Policy (ICC15DTC) issued by Massachusetts Mutual Life Insurance Company (MassMutual), Springfield, MA 01111 and offered exclusively through Haven Life Insurance Agency, LLC. Not all riders are available in all states. Our Agency license number in California is 0K71922 and in Arkansas, 100139527.

Sherry

Thursday 28th of June 2018

Having life insurance is so important. My husband and I have had it for years. It gives me peace of mind that my family won't have to worry about the extra expenses should something happen.

Dawn Lopez

Thursday 28th of June 2018

I find life insurance a bit confusing. It’s good to know that there are guides to help you figure it out.

Toni | Boulder Locavore

Thursday 28th of June 2018

This is really helpful to understand why insurance is important for the family. Thanks for sharing this info.

krystal

Wednesday 27th of June 2018

It is so important to get everything organized financially. Take the time to get your affairs in order.

brianne

Wednesday 27th of June 2018

What a super informative and helpful post. None of us want to talk life insurance but it's definitely something we all need to talk about and GET!