This conversation is sponsored by BusyKid. All opinions are my own.

Money is a powerful tool that can propel our children forward to independence and confidence. On the other hand, not understanding how money works and having a financial understanding can cripple our children as they spend, get in debt, and don’t know how to budget.

It’s so important that we take the time to teach our children how to handle money and what it’s value is really worth so they can be the responsible and independent young adults we all hope they will become.

It may not surprise you to know that:

33% of youngsters haven’t been taught how to get or earn money

41% of children haven’t been taught how to spend money

47% have not learned how to give money to help people

Findings from the Junior Achievement-Jackson Children’s Financial Literacy Survey

There are easy, everyday moments in our children’s lives that we can use as a teaching tool to develop their understanding of money. We’ve partnered with BusyKid, an innovative new way to handle allowance, to share 8 easy ways to teach your kids to handle money. It’s time to start thinking about how you can use the everyday experiences around you to prepare your children for their future.

8 Easy Ways to Teach Your Kids About Money

1. Use Allowance with Chores – Chores are the “work” of childhood and can be a really helpful tool to introduce money in an appropriate way. Set up a system to have your children earn an allowance each week for work they complete around the home. Avoid giving a weekly “allowance” just for being alive. Our goal here is to teach children to be independent and responsible for their own expenses, not to expect something for nothing.

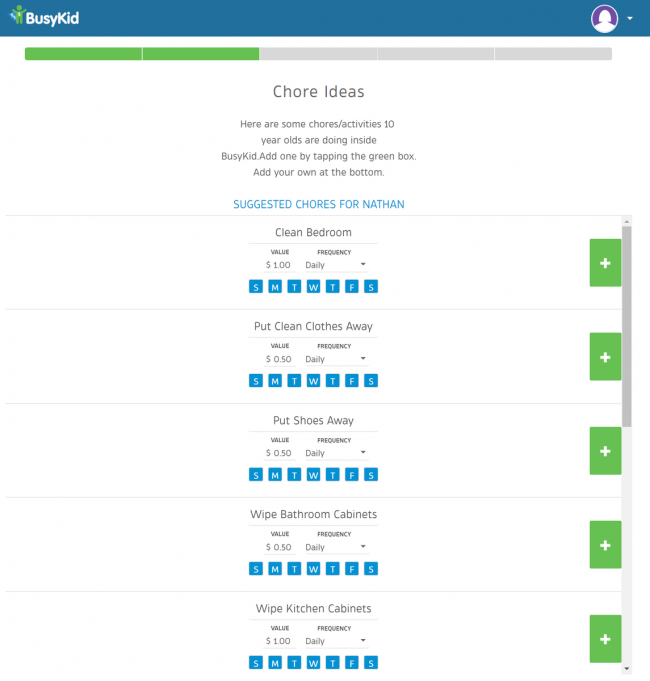

BusyKid makes it incredibly easy to setup a chore schedule and budget. They base the suggested chores and value on a study completed that gauged what the average parent does and on what other jobs similar children of your child’s age are doing. It will help you pick out jobs just right for their age, or add your own, and adjust the budgets to fit your overall monthly family budgets.

I setup a profile for my 10 year old and suggested chores included:

- Clean bedroom

- Put away clothes

- Put shoes away

- Wipe bathroom cabinet

- Wipe kitchen cabinets

- Brush teeth (am/pm)

- Floss teeth

- Water indoor plants

- Make bed

- Load dishwasher

Figure out a monthly budget that will work for your family for chores each month. From there, divvy that chore budget across all of your children. You might give fewer chores to younger children and a smaller budget or make it all equal – that will depend on your family structure.

Next, decide how to best assign each monthly budget to each child. By starting with our monthly allotment first, you’ll be able to balance assigned jobs and their value so you don’t bust your own bank account in the process. Everything on BusyKid can be completely adjusted to meet your individual family needs.

2. Give them a Shopping Budget – A crucial party of managing money is understanding a budget and how to stick to one. We can give our kids experiences with a budget to help them learn to sort wants and needs. At the start of the school year, set a dollar amount to go to school supplies and another for clothes. Let your children make decisions based on their budget, and stick to it!

Don’t go over just because they’re a really cool backpack or designer pair of jeans they really want. Let them make sacrifices and determine what they really need and cover those first, and fill in what is left from their wants list.

You can use a budget for birthday party gifts, summer entertainment, grocery shopping for lunch supplies, and other times throughout the year.

3. Let Them Sell Their Belongings – Give your kids the opportunity to sell their things they no longer need or use to understand the value of items. It will become apparent pretty quickly how that $20 toy is now only worth maybe $2-5 sold through a garage sale or swap shop group.

This will help them make better decisions when buying items in the future and teach them to value the things that they do own, rather than having the mentality of trading up for bigger or better.

4. Demonstrate Generosity – The best way to teach children to give back is to show this by example. If your children hear you saying you’d be happy to round-up your purchase as a donation to those in need and see you willing to help friends and family in their times of struggle, they’ll adopt the same generosity in their own lives much more easily.

5. Give Incentives for Saving – Saving can be really hard. To put that money aside and not look at all the things we might want to do with it today. Because $1 tomorrow doesn’t feel like it has more value than that $1 today, it’s a great idea to offer an extra incentive to your children if they choose to save their money.

The reality of money is there isn’t a huge return from savings accounts and even some investments don’t pay off in a big way for a long time. But there is a huge benefit that isn’t seen when we save – the security and peace that comes knowing you can take care of the unexpected as you are prepared for that rainy day.

You could offer a 10% bonus for any funds they decide to save or match their savings with a $1 for $1 approach like a 401(k) or whatever works best for your family.

If you don’t have the means to offer monetary incentives, make physical incentives instead such as a large printout that shows what they are saving for to give them another reason to choose savings over spending today on more trivial items.

6. Use Performance Bonuses – You can teach your children to work hard and put their best effort into whatever they do by giving bonuses. You can give bonuses they can expect and specifically work towards like a bonus for good grades on their report card. When you notice they did an extra good job cleaning their room without being asked, give them a little extra bonus from time-to-time to show your children that work ethic matters.

7. Plan a Family Vacation Together – Start by talking to your children about how much money the family can set aside each month to save for a vacation. You can brainstorm together things to cut from the budget in order to work towards the family vacation faster, such as cutting out dining out or taking on less monthly entertainment options to save for a vacation.

The next step is to talk out ideas together as a family of what might be the perfect vacation destination. Would they rather save up for a big trip on the other side of the country or go somewhere within a short driving distance to take a trip sooner?

Discuss how much the different expenses will be and let them help make decisions. They can help plan the activities and applying that budget towards the activities that will be the best value for your families enjoyment and limited budget.

Better yet, let the kids help by pitching in each month towards the family vacation budget to feel the accomplishment of saving for something big.

8. Let them make financial decisions – Avoid using programs that use stickers or IOU’s, kids need to feel a sense of ownership for the money they earn and be able to make important decisions while they are young. It’s much better for them to learn lessons about blowing all their cash on something that doesn’t last when they’re young and only have $100 to lose than when they’re a young adult and can no longer pay their rent because they bought a flat screen TV.

The thing is, kids aren’t going to experience money the way we did growing up. The reality of our children’s future is that traditional dollar bills and coins aren’t really how they’ll use and interact with money as they become a teenager and adult. Technology is moving faster than ever and the majority of transactions happen through a debit or credit card or even directly online without it feeling like much of a transaction even took place.

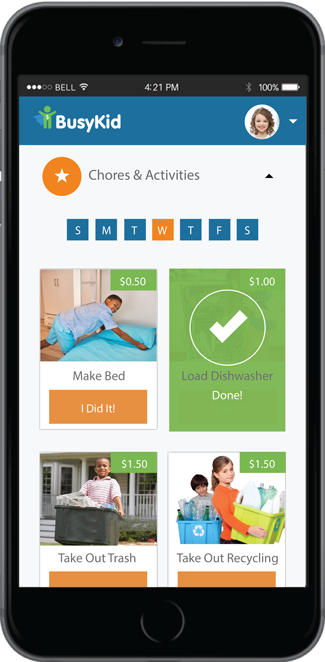

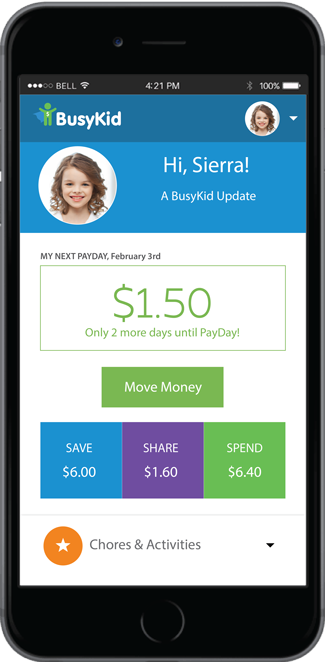

BusyKid is revolutionizing the way we teach our children about digital transactions and how money really operates with their website and app that takes off all the tedious parts of allowance for parents and lets children be able to make smart choices of how to use their money earned.

Parents securely link their bank account within BusyKid and the weekly allowance is withdrawn from your account each Friday and reserved aside in your child’s name. All the accounting is taken care of so your child sees their weekly deposit and account balances easily.

Kids can keep their savings held in their account or choose to invest their savings in stocks. Their spend account can let them purchase gift cards or ask for cash out. Kids can even donate some of their earnings to one of the linked charities within BusyKid to remind them to give back to others. Parents have the ultimate control to approve transactions which makes conversations and financial advice conversations happen.

Any gift cards are stored securely within your child’s account and can be accessed and use for entertainment or shopping. The cash-out option diverts the funds back to your checking account to reimburse you for a purchase of something your child wanted in-store or for you to pull out cash for your child.

Visit BusyKid.com to try out their service free for the first 30-day! If you love the simplicity of the service, it’s just $12 a year for the whole family.

There are so many important lessons our children are going to need to learn, the hard way, about money. Let them learn those lessons while you’re by their side to help and explain things, to create a generation that is confident, frugal, and wise about their money.

What other ways do you have to teach kids about money?

Jennifer G

Thursday 11th of May 2017

Teaching children about money is so important. Start teaching them young and they will have a good relationship with money.

Amanda West

Wednesday 10th of May 2017

My kids are trying to learn the art of raising money, these are great ideas! It's so important to teach them the value of earning it.

Jocelyn @ Hip Mama's Place

Wednesday 10th of May 2017

These are very helpful tips to get kids to learn the value of money. I've been slowly teaching my boys to be responsible about money and spending it wisely. I will need to check out this app.

reesa

Wednesday 10th of May 2017

I have to say, this is really great. I feel like my kids have no concept of money, even though we try to explain it to them!

Toni | Boulder Locavore

Tuesday 9th of May 2017

These are really great tips! And I think I could use this app with my kids. Such a great way to teach them to be responsible and work for their allowance.