This post is sponsored by Staples. All opinions are my own.

Hello, tax season! Do you dread it or dream of it? Will you owe the government this year or are you looking forward to a nice big refund check?

Ever since I started blogging and adding a self employment income to our household, we’ve owed money each year. It always feels like a mound of paperwork to get buried in an a scramble to make sure you’re getting all the deductions possible. I would be over the moon to win the Staples Tax Rewards Sweepstakes that’s running now. I would easily win the maximum prize award of $15,000 with our tax liability.

Read on for some great tips for a better tax year and more information on the sweepstakes below!

6 Tips for a Better Tax Season

1. Hire it out – If your tax situation is confusing or overwhelming, using a tax professional can help eliminate a good portion of the stress and help you feel secure in your submitted tax reports. You’ll still need to gather paperwork for your accountant, but the confusion can be handled for you.

2. Keep your receipts – File away receipts that might be needed at tax season in an easy to find folder. You can expense medical expenses, business expenses, child care expenses, and lots of other items!

3. File it away – Stay organized by created a dedicated spot to store everything related to your taxes. That could be a spot in your filing cabinet or a simple box on your desk – whatever works for you label it to help remind you where everything is stashed for tax season.

4. Record Everything – Keeping a running record of what happened during the year can simplify your tax preparation a ton. Take note of mileage if you travel for work. Jot down your list of clients and projects if you work freelance or contractor based work. Mark down records of doctor visits and prescriptions so you can run through your list when you are looking for those expenses and receipts and find what you need.

5. Compare with your last year’s tax summary – Pulling out your previous year’s tax return forms can give you a step-by-step view of what to look for and remind you of items you typically deduct. It can also be really helpful for assessing what changed through the year and why your tax numbers look the way they ended up this year.

6. Deductions, deductions – Look for every possible deduction you can to make the most out of where your money goes come tax season. Investing in retirement can offer a huge benefit to your tax bottom line. Donating to a cause that you care about can be beneficial if you itemize your deductions. Take a pile of items your family no longer needs to donate to Goodwill and you can write off those donations, too. Saving for your children’s future can be another avenue to save you on your tax bill.

Staples Tax Reward Sweepstakes

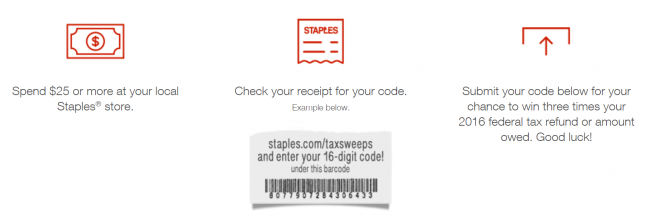

Staples is running an amazing Tax Reward Sweepstakes with a huge payout! Two lucky winners will win a prize, worth up to $15,000! You can enter for a chance to win three times your federal tax refund or amount owed.

The prize has a minimum value of $5,000 and a maximum prize value of $15,000. It’s about to be someone’s best tax season yet — and it could be you!

Here’s how to enter:

- Spend $25 or more at your local Staples store in a single transaction.

- Check your receipt for a 16-digit code

- Head to staples.com/taxsweeps to submit your unique code for a chance to win!

The Tax Reward Sweepstakes is valid from 4/9/2017 through 4/29/2017.

Don’t miss your chance to win big this tax season! Visit your local Staples store to shop in store and earn your entry! For the official rules and more details, visit staples.com/taxsweeps.

Toni | Boulder Locavore

Tuesday 18th of April 2017

These are really helpful!! Thank you so much for sharing your tips!!

Dawn McAlexander

Monday 17th of April 2017

I was so scared when we went to file our taxes. It wound up okay, though. But I do recommend highly getting every deduction that you can take.

Tania

Monday 17th of April 2017

I basically did everything wrong this year for taxes! Thank you for the tips, so I'll be better off next year. I'm off to enter the Staples sweepstakes, because I owe the government money, lol.

Sinisa

Monday 17th of April 2017

Great tips for tax season. Tax day is tomorrow

Kim @ 730 Sage Street

Monday 17th of April 2017

We have been hiring a pro for years and it definitely makes it easier. I also record everything in Quickbooks at the end of each month so I just hand him the file at the end of the year. Easy!