Almost a full year ago we paid off the last of our student loans and began to build up our savings. Being debt free, other than our mortgage, gave us such a feeling of a weight being lifted off of us we didn’t even realize we had. But that was just the start of our journey. Once we paid off our debt, we then built up a 6-month emergency supply. This savings would let us take care of ourselves if my husband were to ever lose his job or one of us got really sick or some other emergency. Having a savings in place has given us peace of mind. Along the way, there are a few things I have learned that have helped us as a family to more easily save. Here are my tips for maximizing family savings:

First, it is important to have a savings account in place. I have found it works best to have a savings account that isn’t at the same bank as your checking account. When I previously tried to save, it was too easy to transfer over the funds or set up my bank to automatically transfer over from my savings if my account ever went low. Having my savings set aside where I don’t see it daily when I look at my checking account balance really helps to keep from tapping into our savings.

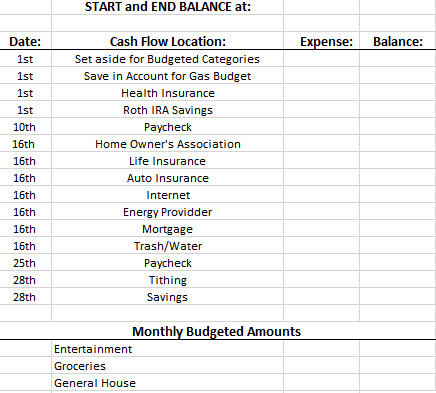

Sample Budget Planning Worksheet – “Cash Flow”

Next, make and stick to a budget. I created a simple budget planning worksheet in excel that I called my “cash flow”. I wrote down what days of the month bills would go out and what part of each paycheck I could assign to each of those bills and other monthly expenses. Then, at any day of the month I can compare my checking balance to this cash flow spreadsheet and see how much of a balance I should have and quickly see what bills are coming up next. This had made a huge difference in understanding where my money is and goes and working with my budget. Be sure to assign every dollar a “name” whether it be for a bill, to pay off debt, to add to your savings, or for groceries and other expenses.

Display your goals and make it easy to see your progress. I created a goals chart that we’ve been using this year and marking off what financial progress we have been making throughout the year. It can be hard to feel like you are accomplishing anything when your money just goes into a savings or retirement or towards other goals. I have found that having my goals and progress displayed somewhere I see them daily makes it easier to keep moving forward towards those goals without getting distracted.

What steps do you take to maximize your family savings?

Bekah Kuczenski

Wednesday 5th of June 2013

Right now we unfortunately do not save too much money. I have huge amounts of student loans that don't leave a lot of wiggle room for saving :( I dream of being student loan free....

AshleyWalkup

Wednesday 5th of June 2013

Yay for paying off student loans and saving!! It's great to have a budget and to save.

Ashley Nolan

Wednesday 5th of June 2013

Thanks for the savings idea's, I'll have to talk about it with my husband.

Karen Klepsteen

Wednesday 5th of June 2013

I tried to get my husband to sit down and do a budget, but when I told him to base it off of 40 hours a week, we didn't have enough money to eat or get gas. Unfortunately, his hours vary from week to week so our budget is a very fluid thing. I hate it.

AshleyWalkup

Wednesday 5th of June 2013

What my husband and I now do is we live off of all the money we made last month and we don't spend a dime of the money we make this month...until next month. It took a while to get enough built up so we could do this but it helps make life so much easier when you have an income that varies. Just an idea!

A Mom's Take

Wednesday 5th of June 2013

In your situation, start your budget off of what the minimum you think will come in throughout the month. Then, make a list by priority for any additional income if he does meet the 40 hours. For example, if you did 20 hours of income and then got to 25 you could put money towards the first 3 things on the list (more for groceries or whatever it might be for your family). It is hard to work with a budget without a set income but that can at least help.

suelee1998

Wednesday 5th of June 2013

thanks for this great info, I am always looking for ways to save money.