I tried for years with many, many attempts at budgeting, without much success. You’ve been there too, right? I would throw numbers down on a sheet of paper and then fumble my way through the month unsure each day where my bank balance should be and how each bill would affect my balance. Something would always surprise me and throw off my budget leaving me feeling frustrated and ready to quit. Until one day it hit me, I finally got itfin

This post is sponsored by EveryDollar. All opinions are my own.

The thing that made all the difference was understanding my daily account balance. Instead of just throwing numbers into a spreadsheet and hoping they all worked out, I had to actually account for every dollar, every month, and make sure that my budget would be able to handle each planned transaction that would come through my account.

Here’s an example: Let’s say you have a $2,000 check coming in on the 10th, and so you plan your bills around this income. If all your bills come out of your account on the 8th, you can’t count on the check on the 10th to be able to cover those bills. If you did, your account would fall negative and accrue all sorts of late fees and when your check comes in to save the day, it is no longer enough.

On paper your bills and your income are accounted for, but they aren’t planned to allow your money to cycle through your account and cover each of your bills the way they should be.

Are you ready to make these budgeting secrets change and transform the way you plan your money each month? I’ll show you how!

Step 1: Assess your income and expenses

Find out exactly how much money you bring in each month and what your expenses are. If your income varies based on commissions or overtime, start your budget by planning for the minimum payment you receive in a month and prioritize your expenses to base them off your actual income.

Look over your last 3 months of expenses and figure out how much you are spending on each category such as food, clothing, gas, and other variable expenses. This will help you make a realistic budget based on how much you actually spend in a month.

** Budget Tips: A unique idea for variable incomes is to work towards spending one month behind your income. Whatever you earn in January becomes your built-in savings. You’ll then budget and spend/save your January earnings in February and save up February’s income to roll back again into March. This is a neat way to create a savings buffer and know exactly how much to budget each month.

Step 2: Plan your budget

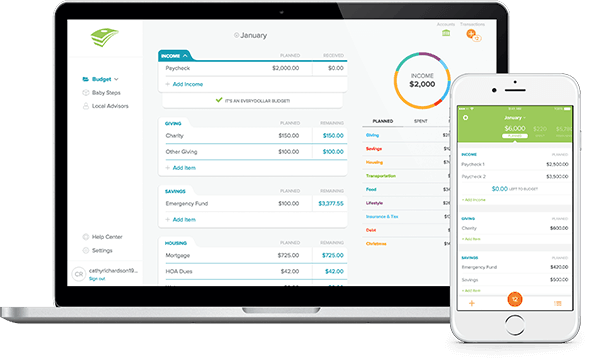

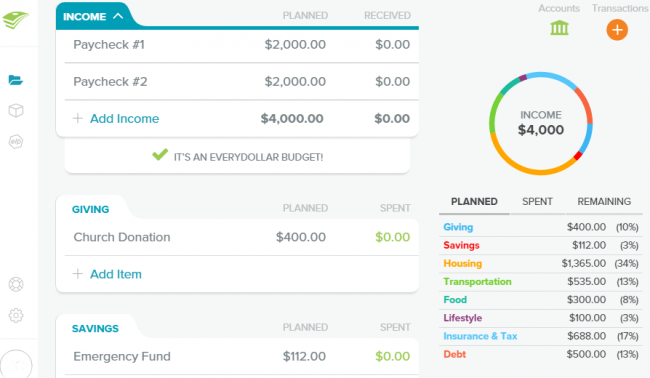

I’m using EveryDollar’s free budgeting tool to chart my budget. You can quickly and easily set up your own personalized budget for each of your expenses and income. There are prompts and expense starters already filled in to help you easily create your budget and make sure each of your income dollars are matched with where they will go each month.

Start by adding your income into the budget. Then, make your way through the budget sheet adding every expense you incur during the month. Some expenses will be fixed such as insurance premiums and mortgage/rent payments. For your variable bills such as gas, groceries, and household budgets, assign a budgeted amount that will work within the income you have left for the month.

Make sure every single dollar of income has a name to it: where you will spend, save, invest, or give each dollar of your funds.

You’ll be able to set up your entire budget, and adjust as needed, in under 10 minutes! EveryDollar is so simple that even someone who has never created a budget before can create their first budget in minutes!

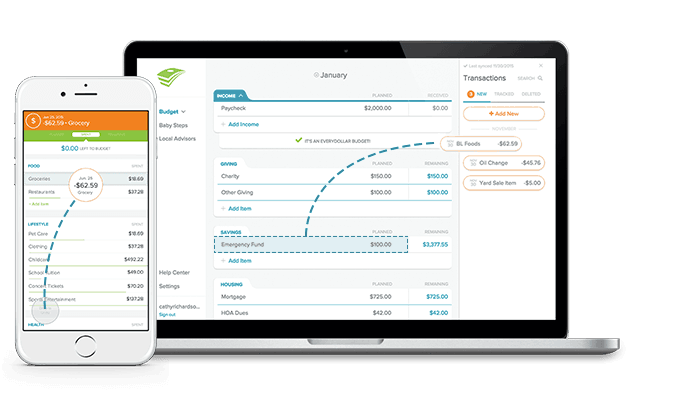

To take your budgeting to the next level, you can join EveryDollar Plus to be able to view real time balance on each of your budgeted accounts to help you stay on track throughout the month.

It’s as easy as syncing your bank account and then dragging and dropping your transactions to their assigned budgets. EveryDollar does all the math letting you quickly see how much you’ve budgeted, spent, and have left remaining in each of your budgets.

Join EveryDollar for free to get started budgeting with ease (and without pencil and paper!) You can even try out a 2-week free trial of EveryDollar Plus to see if it’s the right fit for you.

Step 3: Chart your daily account balance

Step 2 is where most people stop. They have a plan, and they’re ready to stick to it. But step 3 is going to totally transform the way you look at and understand your budget and where you are at for the month.

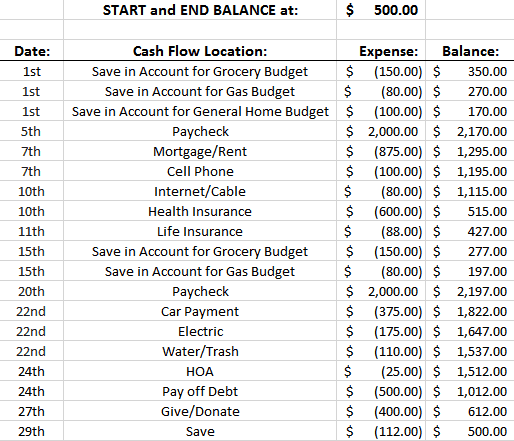

Once you’ve created your budget, we’re now going to create a chronological view of your monthly bills, income, and expenses. I call this my “cash flow” or where the money comes and goes throughout the month. This will help you very easily see if you are on track each day of the month and help you stay within your budget.

Here’s how our Budget Tips work:

- At the top of the sheet, note what amount you need at day one of the month to be able to cover all of the bills. This number should also be the same number that you end the month on and roll over into the following month. Let’s use an example of $500 as our starting account number.

- Next, add the bills and income you receive by date for fixed expenses. Start by putting the date, then a description of the expense/income, and then we will balance our cash flow of income/expenses as we work through the month.

- Any day of the month, you can come into your cash flow sheet and see where your account balance should be for the month. For example, if I looked at my account on the 10th, I would see that I would have two bills coming out that day, if they were not already reflected on my bank statement. I would know that my account balance should be at or above (not lower than) $515.

- Keep in mind, if you don’t pull out cash for flexible budgets like your grocery and gas, you’ll need to keep track of how much you have left available for the month, like maybe you still have $40 for gas left and $65 for groceries and all the rest of your bills came out as planned, your account balance should then be at $620.

Seeing the current balance in your bank now means something. You can see that just because your bank shows $500 in your account, that doesn’t mean you have $500 to spend. You have all of your money currently accounted for and know exactly what is coming up next. Just as we keep a balance in our account at the end of the month in this example of $500, that isn’t money you have available to splurge – that little bit left over from the previous month carries you through the first 5 days of the month until your first paycheck. That money already has a name and a place in your budget.

Using a budget together with a cash flow sheet has helped me understand my current bank account balance and has made all the difference in staying on track without busting my budget.

Visit EveryDollar.com to set up your own free budget and take over your financial future!

Erica

Saturday 26th of March 2016

Mint is helpful, but it's just a tool. What have been really helpful for me and my family is to follow the process that Dave Ramsey teaches. It's simple, but actually really hard to do. Money is emotional. And there are feelings involved. And, self discipline - oh my. How hard that can be!

Jennifer Mercurio

Wednesday 27th of January 2016

I am so horrible at budgeting and saving. I could definitely use a tool like this and I can 100% see it helping me and my family!

Amy Desrosiers

Tuesday 26th of January 2016

I have been doing this same thing for years. I like to have a five thousand dollar cushion in my checking to help cash flow for online bill pay and such.

OurFamilyWorld

Tuesday 26th of January 2016

I hate budgeting, but I have to do it. I love your tips!

Sabrina

Monday 25th of January 2016

Love budgeting! The more organized I am the more relaxed about things that come up!